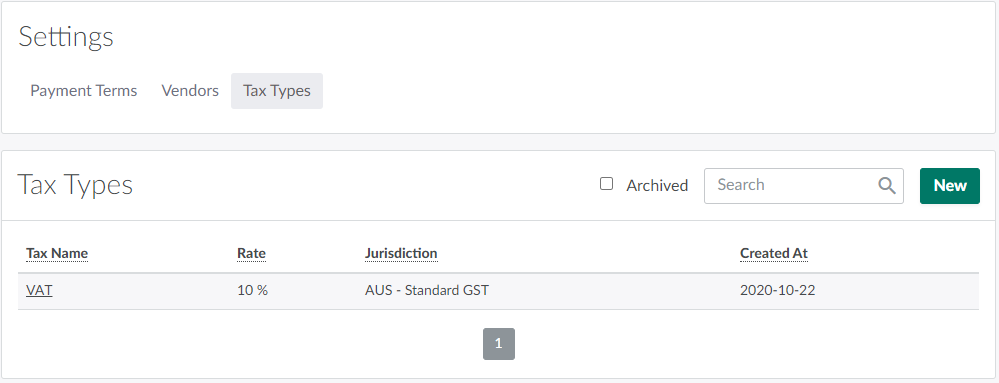

Through the Tax Types sub-tab, you can configure custom tax rates for specific jurisdictions. When creating a Sales Order, you can select the tax rate that applies to the order or specific order items.

Required permission(s): tax_type_read, tax_type_create

-

In the Wholesale application, open the Settings tab.

-

Open the Tax Types sub-tab.

-

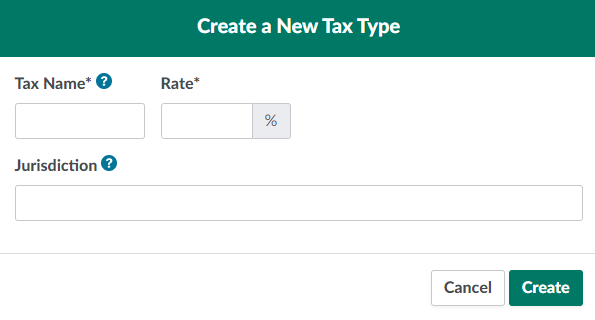

Click New. This opens the Create a New Tax Type modal.

-

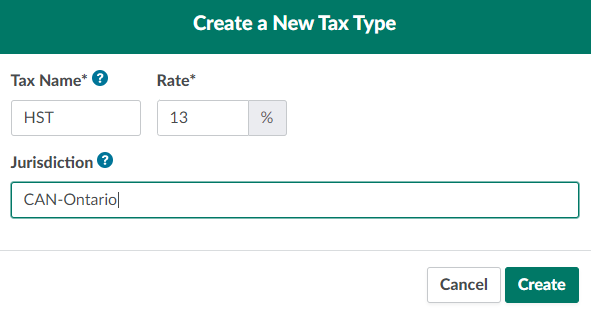

Configure the tax type’s details in the fields provided.

- Tax Name: The tax type’s abbreviated name–GST, PST, etc. This field will accept a maximum of five characters.

- Rate: The tax rate. This may not exceed 100%.

- Jurisdiction: The jurisdiction in which the tax type is applicable. This assists users in selecting the correct tax types when creating Sales Orders.

-

Click Create to add the new tax type.

From the Wholesale application's Settings tab, you can also Add a Payment Term or Create a Vendor Category.